Looking forward to 2025, the development trend of MIM in the consumer industry

With the increase in the penetration rate of folding screens, it is expected to become a new explosive point for MIM technology consumer electronics applications, including smart wearables, smartwatches, and other new products. MIM products are expected to have room for steady improvement from 2023-2025.

Structural opportunities for mobile terminals superimpose emerging product innovations. MIM products in the field of consumer electronics are widely used in various hardware devices, including traditional hardware devices such as smartphones, tablet computers, and notebook computers, as well as emerging hardware devices such as smart wearables and unmanned aircraft. support, camera ring, buttons, and other forms. In terms of different terminal products, we believe that the opportunities for consumer electronics mainly lie in the function enhancement of mobile phones and emerging consumer electronics applications.

(1) Smart terminals: In the short term, the opportunities mainly lie in the recovery of demand at the bottom and the replacement of the Apple iPad interface.

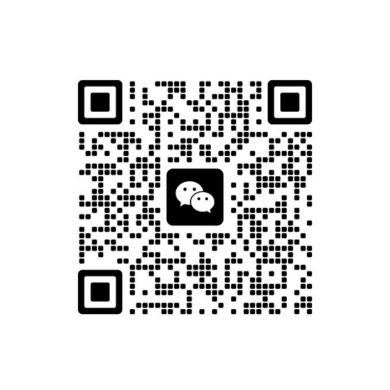

(a) In the short term, the bottom recovery trend of demand is obvious. According to Counterpoint, the average replacement cycle for global users in 2022 has exceeded 31 months, and in the long run, there is limited room for growth in mobile phone sales. However, there is a chance of a rebound in the short term. From 2022 to May, China’s mobile phone shipments will continue to be negative year-on-year, and consumer demand for mobile phones will continue to be sluggish. Since June, the impact of the epidemic has weakened. , terminal demand is gradually recovering, Apple mobile phones are performing strongly, and consumer electronics is showing a clear trend of recovery from the bottom cycle. Data from the China Academy of Information and Communications Technology show that, the overall domestic mobile phone market shipments in June 2022 increased by 9.8% year-on-year, +34.6% month-on-month, and the year-on-year change in a single month was the first time since the beginning of the year that it turned from negative to positive. From January to June 2022, the cumulative mobile phone shipments will decline by 22% year-on-year. Considering that it is currently at the bottom of the consumer electronics cycle, factors such as low and peak seasons, and the launch of Apple’s new iPhone 14 and AR/VR products, we are optimistic about the upward opportunities in the mobile phone cycle in the second half of the year. (b) Apple iPad products replace the Type C interface to provide replacement space. The 1H22 revenue of the consumer electronics sector was 546.2 billion yuan, a year-on-year increase of 5.5%. The net profit attributable to the parent firm was 20.1 billion yuan, a 30% reduction year on year.

Chart 26: Mobile phone shipments in China

Chart 27: China folding mobile phone shipments

According to IDC and SA data, global smartphone shipments in 2022Q1 and Q2 decreased by 8.9% and 7% year-on-year, and global tablet shipments in 2022Q1 and Q2 were 38.4 million and 40.5 million units, respectively -3.9% and +0.15% year-on-year. The decrease in the tablet terminal is smaller than that in the mobile terminal. Apple, the most important brand of iPad, shipped 24.7 million units worldwide in the first half of the year, and its share fell by about 3.5% year-on-year. However, it is still the best-selling tablet brand in the world, and there is an alternative demand for interface replacement. Specifically, Apple’s iPad products are mainly catalyzed by the European Union’s unified regional agreement. Before 2024, the entire iPad product line will be converted from Lightening to Type C interfaces, while Apple’s existing Type C products’ precision structural parts technical solutions mainly adopt MIM technology. ¾

In the long run, the opportunity mainly lies in the structural upgrade of subdivided functions, and the subdivided market maintains high growth.

(a) Folding screens for mobile phone terminals: In 2022Q1, China’s smartphone shipments fell sharply. According to Counterpoint data, the sales volume of China’s folding screen smartphones market in 2022Q1 was 670,000 units, representing a 391% year-on-year growth and a 152% month-on-month increase. According to the strong growth tendency, shipments of China’s folding screen smartphone market are expected to climb by 225% year on year in 2022, reaching 2.7 million units. The hinge design of the folding screen requires higher component complexity and processing accuracy. For example, the hinge part of the OPPO folding machine has 136 components. Huawei Mate Xs 2’s original double-rotor eagle wing hinge achieves precise linkage. The thickness of the stressed structure is reduced. Company In-depth Research – 14 – Please refer to the special statement on the last page ¡The hinge is one of the core precision components of the folding screen mobile phone, and it needs to take into account both performance and cost. Under the premise of lightweight and small size, to ensure the stable and reliable function of the folding screen, the hinge needs to have an opening and closing life of at least 100,000 times and also needs to guarantee the cost. Taking Samsung Galaxy Fold as an example, the mechanical/electromechanical in the BOM table The cost of structural parts is $57.7 higher than that of the Galaxy S9+ mobile phone, mainly due to the ultra-thin UTGA cover, hinge, and two isolated middle frames that increase the number of metal middle frames.

(b) Multi-camera of mobile phone terminals: Taking MIM camera brackets and rotating shafts as examples, MIM camera brackets will benefit from the multi-camera penetration trend of smartphones around the world. new flash point.

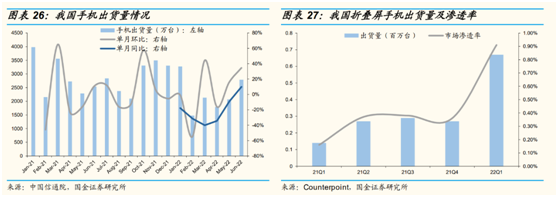

(2) Applications such as smart wearables and unmanned aircraft have created considerable growth in MIM products. According to Frost Sullivan, the size of my country’s civilian drone market has increased from 7.9 billion yuan in 2017 to 40.1 billion yuan in 2021, with a 4-year CAGR of 50%, and is expected to reach 45.3 billion yuan in 2022. According to Counterpoint, global smartwatch shipments will reach 128 million units in 2021, a year-on-year increase of 28.31% over 2020. It is expected that global smartwatch shipments will still have room for growth in the future.

Chart 28: Global smartwatch shipments

Chart 29: China civil UAV market forecast

From the above data analysis, looking forward to 2025, MIM has a short-term growth trend in the consumer industry.

Tags: