Where will China's MIM industry go post-smartphone?

Background

According to known data, the combined revenue of MIM products in mainland China and Taiwan surpassed that of North America, Europe and Japan in 2011. In 2020, it exceeded 1.5 billion US dollars (equivalent to 10 billion yuan), and the number of MIM factories has also increased from less than 50 to more than 200. China has become the country with the largest quantity and turnover of MIM products in the world. The four major process equipment used in the MIM process: mixing and granulation of feeding materials, injection molding of green bodies, catalytic degreasing of degreased bodies, and sintering of silver billets have also become the most cost-effective in the world and are exported to other countries. All kinds of signs show that the MIM process is widely favored by the world, gradually catching up with traditional powder pressing and leading advanced metal 3D printing by a lot. However, after nearly five years of observation, Dr.Q found that at the beginning of the development of the new crown epidemic (at the end of 2019), orders for MIM parts.

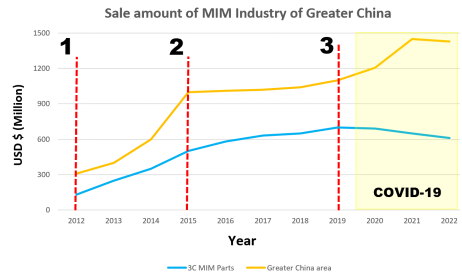

Figure 1 shows the total annual sales of MIM in the Greater China region. We specifically distinguish the total amount of 3C MIM products used in: smartphones, tablets, notebooks, desktops and servers, and smart wearable devices. The three numbers marked on the figure are the starting points of the three stages, all of which are closely related to the development of smartphones:

Stage 1: Apple Inc. of the United States began to use MIM parts to enter smartphones. This is the era when the MIM industry began to take off in China. Responding to the MIM demand of APPLE, the MIM factory is represented by Taiwan Taiyao Technology (the former parent company of Suzhou Zhongyao) and Shanghai Fuchi Technology. The main parts are SIM card tray ejection mechanism and mobile phone internal parts. Taiwan’s Xinrixing invested, and Apple’s hinges on notebook computers gradually switched to MIM technology.

The second stage: Taiwan’s HTC (HTC, has been acquired by Google) began to adopt the MIM process as the main body of the SIM card tray, which indirectly also led domestic mobile phone brands to start with Huawei (HUAWEI) and expand to Oppo (OPPO), Vivo, Xiaomi (MI), MIM parts include mobile phone lens protection ring (Camera ring), side button (Side volume key and powder key), connector interface (I/O port), etc. Since 2018, domestic smartphones use micro-gear reducers and cameras to combine into elevating lens modules, and MIM parts gradually reach the peak under the turnover of smartphones.

The third stage: Although APPLE uses the new MIM material cobalt-chromium-molybdenum alloy (ASTM-F75) to make the rear camera lens protection ring of mobile phones and tablets, it brings the peak of MIM. Unfortunately, at this time, domestic smartphones began to phase out the MIM process, the main factor being price considerations. In addition, APPLE occupies the top ten MIM suppliers, which limits the production capacity and quality of MIM. Non-APPLE smartphones have switched to traditional metal stamping and plastic products to replace MIM parts. However, because the arrival of the new crown epidemic has increased the demand for notebook computers and the emergence of folding screen mobile phones, MIM’s hinge parts have at least recovered the decline in overall sales.

Figure 1. Comparison of the total sales of MIM parts in Greater China and the total sales of MIM used in 3C products

Beginning in the third stage, MIM operators in the Greater China region have already felt the breath of change. Due to the sudden drop in demand for MIM parts factories that used to produce domestic smartphones, some MIM companies have no orders. These MIM operators began to change direction in order to survive. Therefore, there are the following developments.

change product strategy

The MIM industry in the Greater China region has already predicted the downward trend since the beginning of the new crown epidemic. There are several product strategy changes, including:

The expansion of materials expands the application scenarios of products, from traditional iron-nickel alloys (Fe-2, 4, 8Ni to 50Ni), 304/316, 304L/316L, 420J2/440C, W-Ni-Cu, to 201, 17 -4PH, P.A.N.A.C.E.A.®, Fe-50Co (HiperCo®), Fe-3Si, 430, W-Ni-Fe, etc. According to customer needs, the progress of making parts with MIM technology in magnetic functional materials has been greatly increased. Especially for the application of soft magnetic materials and magnetically permeable materials, it has led to the introduction of cobalt elements into the MIM process, including Fe-50Co and ASTMF75, which are widely used in magnetic guidance and electromagnetic shielding of electronic products, with good results. The material change of cemented carbide transforms the previously difficult-to-control W-Ni-Cu into W-Ni-Fe. Cooperating with batch-type graphite vacuum furnace sintering (1480~1500℃), the sintering process can avoid the danger and trouble of hydrogen, and greatly increase the efficiency and safety of production. In addition, the promotion of titanium and titanium alloys in the last three years has also achieved certain results.

As shown in Figure 2, domestic titanium and titanium alloy feeds are also developing vigorously, which has accelerated the use of titanium and titanium alloy materials in the MIM process.

Because China’s stainless steel production capacity is large and widely used, the recycling of stainless steel scraps to spray powder has led to a drop in powder prices. In this way, larger MIM products can afford MIM powder. For example, the average unit price of MIM 304 stainless steel powder is lower than 6 USD/Kg (<40 RMB/Kg), which is already close to the traditional stainless steel 304 powder for PM, and the future development of MIM 201 powder is estimated to be lower than 4.5 USD/Kg (<30 RMB/Kg). /kg), which can directly replace the low-cost stainless steel powder of traditional PM; in-depth exploration of customers for different products, including shafts, sewing machine accessories, fasteners and labels for luxury brand bags, kitchen knives and nail clippers, jigs and tools, golf Club head accessories. It has even begun to invest in the internal components of the gearbox and lithium battery pack of electric vehicles, changing the long order (long product life) and less trendy order (short product life). For example, in the manufacturing of the well-known golf head, the MIM process can produce better surface effects and detailed features than precision casting, forging and die-casting processes. The United States Golf Association (USGA) even considers the MIM process as a standard golf head manufacturing process. What’s more interesting is that in Yangjiang City in southern China, at least 4 MIM factories have combined with local powder manufacturers to produce more than 10 million pieces of kitchen knives (Shibazi-Li’s kitchen knives) and nail clippers per year for MIM 420 stainless steel. Local characteristics and exported to overseas countries.

For example, the small module gear (diameter 3~30mm/M=0.1~1mm) of JH MIM located in Ningbo has passed the sample certification of the American sweeping robot manufacturing company (irobot). In the future, heavy-duty water mopping and sweeping robots will be fully used. This kind of high-strength precision gear made by MIM technology is tempered after heat treatment with 17-4PH H900, which can greatly increase the wear resistance of the gear and replace powder metallurgy gears and brass cutting gear. As shown in Figure 4, the technology of embedding injection plastic with MIM is introduced into the new product system for the first time and has been recognized, and the integration technology of MIM technology has advanced to a more interesting development direction.

Figure 4. Gears made using MIM and finished gears co-injected with plastic

This year happens to be the first year after 50 years since MIM’s first invention was patented. In 1972, the American Parmatech company must not have imagined the grand occasion of MIM today, and it is the MIM manufacturers in the Greater China region that support the overall situation of the global MIM industry. We are very grateful to Parmatech for bringing this new technology to the world. We strive to implement the MIM process as a normal process of metal processing, which is as famous as lost-wax casting, forging, machining and traditional powder metallurgy. At the same time, we will also assist the growth of powder bed technology for metal additive manufacturing, and will help the advancement of binder jetting technology. Everything comes from the combination of particles, we must understand powders in a scientific way. Forging ahead in countless powders, mathematics is our only reliance. Of course, including our diligent and unremitting efforts. The fruitful results in the Greater China region come from the concerted efforts of the global MIM industry and the huge orders from customers. At this time, even if the MIM industry is affected by uncertain factors in the post-smartphone era, there is no need to panic and fear.

Yes, this is a routine operation for most companies before inquiring.

We have metal 3D printing equipment and can provide sample 3D printing.

3D drawings allow engineers to better understand the structure of the product, and 2D documents can provide more information, including materials, tolerances, surface treatment, etc. More detailed information is conducive to more accurate quotations by engineers.

In the case of detailed inquiry drawings and information, it usually only takes 2-3 days for us to give you a detailed quotation, including the product price and mold price.

After confirming the order, we usually take 5-7 days to prepare the DFM report of the product. After confirmation, we spend 25 days to complete the mold, and provide T1 samples to customers for testing in the following 10-15 days.

If there is a problem with the test, we will re-sample it for free based on the feedback and provide a suitable sample.

MIM products MOQ 2000 PCS

CNC products MOQ 2000 PCS

Alu die casting, MOQ 2000 PCS

PM product MOQ 5000 PCS

Typically, the lead time for processing and submitting samples is 30 days. However, according to the order quantity and special requirements of customers, we can extend or shorten the delivery cycle accordingly.

1-year product warranty

World-class testing equipment

30+QC Workers

Key sizes 100% checking before shipment

ISO9001+IATF16949

Usually T/T is used as the payment method

Mold: 50% deposit, 50% payment after confirming the sample.

Bulk production: 30% deposit, 30% see bill of lading Copy, pay 70% balance.